To create, defend, and manage investment plans today and into the future, governments must adapt to deliver the maximum value from their digital applications and infrastructure.

Organizations are making investments to create more agile and adaptable operations that are fit for purpose and capable for delivering high-priority services in cost-effective ways. This includes an increased emphasis on scenario planning and risk management.

Owen Taylor

National Government & Public Sector Leader

PwC Canada

Decision Analytics for Government

Aging infrastructure, public service requirements, political realities, digital transformation initiatives, Environmental, Social, and Governance (ESG) commitments, and ever-increasing demands in an era of scarce resources are forcing governments to rethink their approach to investment planning and management. Risks associated with health and safety needs, environmental impacts, social mandates, and governmental pressures must be addressed. To thrive in this environment, organizations must embrace change and strike the right balance between cost-effectively managing the current business and investing for the future.

How can you be confident you’re making the best decisions that deliver the greatest value and drive your strategic goals?

Copperleaf® has a significant role to play in helping governments successfully navigate these challenges. We help organizations decide what to do when they don’t have enough money or resources to do it all. By developing frameworks to evaluate all investment options on equal footing, we make it easy for clients to compare dissimilar projects—and create plans that are transparent, defensible, and aligned with strategic objectives. The Copperleaf Decision Analytics Solution can help your organization decide where and when to invest to maximize capital efficiency, meet performance targets, manage risk, and achieve your ESG and financial goals.

Proactively Manage Risk Exposure

Explore how different levels of investment impact risk to build a robust, defensible plan.

Improve Planning Efficiency

Assess all investments consistently in a centralized system to break down silos and expedite approvals.

Allocate Funding and Resources with Confidence

Develop executable plans that maximize capital efficiency—while meeting targets and constraints.

Execute Strategic Goals

Align investments with your strategic goals, including financial, net-zero, ESG, reliability, and other targets.

Proven Solution Delivers High ROI

Every Copperleaf client has achieved 100% return on their investment within their first planning cycle—and every organization that has implemented our solution continues to use it successfully today. Measurable results include:

increase in capital efficiency

reduction in risk exposure

reduction in planning time

Create optimal investment plans to drive your strategic objectives

Delivering the highest value means doing the right projects at the right time. This is no easy task for organizations that deal with hundreds of potential investment options, with multiple alternatives and start dates to consider.

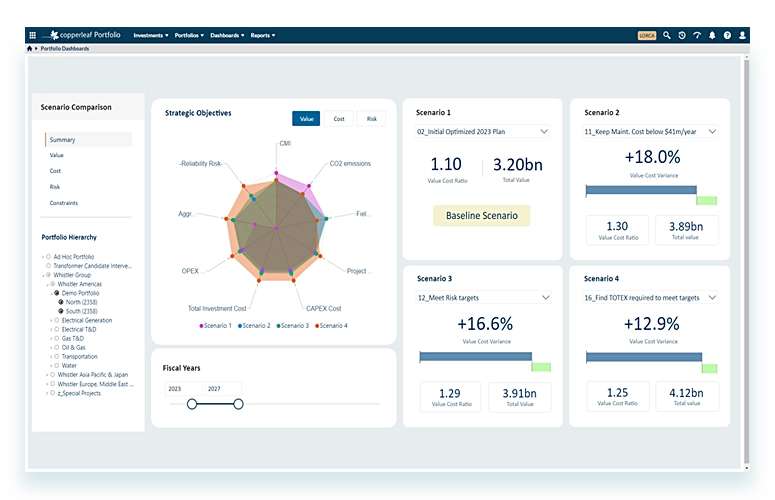

Copperleaf’s AI-powered optimization can evaluate the vast number of possibilities and identify the optimal plan within minutes. Sensitivity analysis can easily be performed to explore the impact of different funding, timing, and resource constraints on value and risk, and build a realistic, deliverable plan to achieve your strategic goals.

Solutions for local governments

Copperleaf and Engineered Intelligence offer a robust, cost-effective, purpose-built solution to help regional and municipal organizations upgrade their asset management and capital planning processes. The combined software platform of ENGIN™ and the Copperleaf Municipal Business Solution can help organizations manage risk effectively and deliver the most value by investing in the right projects at the right time.

Drive your ESG strategy

Copperleaf helps organizations turn aspirational ESG objectives into action by offering a practical way to incorporate ESG metrics into everyday decision making. By expanding your assessment of project value to include impacts on ESG, you’ll be able to:

- Understand how each investment contributes to ESG performance

- Build plans that meet short- and long-term commitments

- Make trade-off decisions that balance business-as-usual and ESG goals

Plan with agility in a dynamic environment

As the business environment changes, new tactical and strategic priorities emerge. Copperleaf makes it easy to quickly run what-if analyses to explore various investment strategies, build consensus, and align investment decisions with new strategic priorities.

Copperleaf enables a continuous planning process by highlighting variances between planned and actual performance. No matter what twists and turns arise during execution, you’ll be able to re-optimize plans, communicate and defend any changes to stakeholders, and adapt quickly to maintain optimal business performance.

Our Product Suite

Copperleaf’s scalable enterprise software solution can grow with you as your business needs evolve. It integrates seamlessly with existing EAM, APM, ERP, GIS, and other systems for more efficient, data-driven decision-making.

Explore our resources

Brochure

Copperleaf Municipal Business Solution

White Paper

Asset Management & ESG: Aligning Investment Decisions with ESG Goals & Objectives

White Paper