Guest Post: Utility Asset Investment Planning Case Study – Northern Gas Networks

This is a guest contribution from Engerati , Europe’s largest community of utilities and power sector professionals.

UK gas distribution company Northern Gas Networks serves 2.7M customers and invests an estimated £300M in assets each year on its network comprising 37,000 km of pipes.

In an Engerati webinar on utility asset investment planning, Head of Asset Strategy Greg Dodd explains that in such a highly regulated sector, the ongoing challenge for Northern Gas Networks is knowing how best to spend its maintenance and investment funds to ensure it reaches its goals of being efficient, safe and maintaining asset integrity.

Like many asset-intensive organisations, the utility was using a traditional prioritisation technique to select which combination of investments to pursue.

Northern Gas Networks knew this approach wasn’t sustainable, says Dodd. “We needed to put more analysis and time into why we’re spending customers’ money, the benefits we’re delivering, and the residual risk that we’re holding in the business.”

The utility turned to Canadian decision analytics company Copperleaf to help the company work towards “risk-informed, value-based decision making”.

In contrast to traditional prioritisation techniques, where a list of projects are ranked, Copperleaf uses advanced analytical techniques to optimise portfolios of investment to determine the investment strategy that will deliver the greatest value, while respecting all funding, resource and timing constraints.

Joining Dodd as a presenter on the webinar, Stefan Sadnicki, Managing Director for Europe at Copperleaf, reported how applying a mathematical optimisation approach to an Excel-based exercise delivers 7-20% more value on a portfolio than using prioritisation.

Sadnicki said: “Predictive analytics can lead to the development of long-term asset strategies by identifying the level of investment that is required to keep risks at an acceptable level.”

Asset investment benefits framework

Over the past 10 years, Copperleaf has collected a robust dataset on the benefits of Asset Investment Planning and Management (AIPM) capabilities through its work with over 30 utilities globally. Copperleaf also commissioned a study through the University of Southampton – and used third-party research.

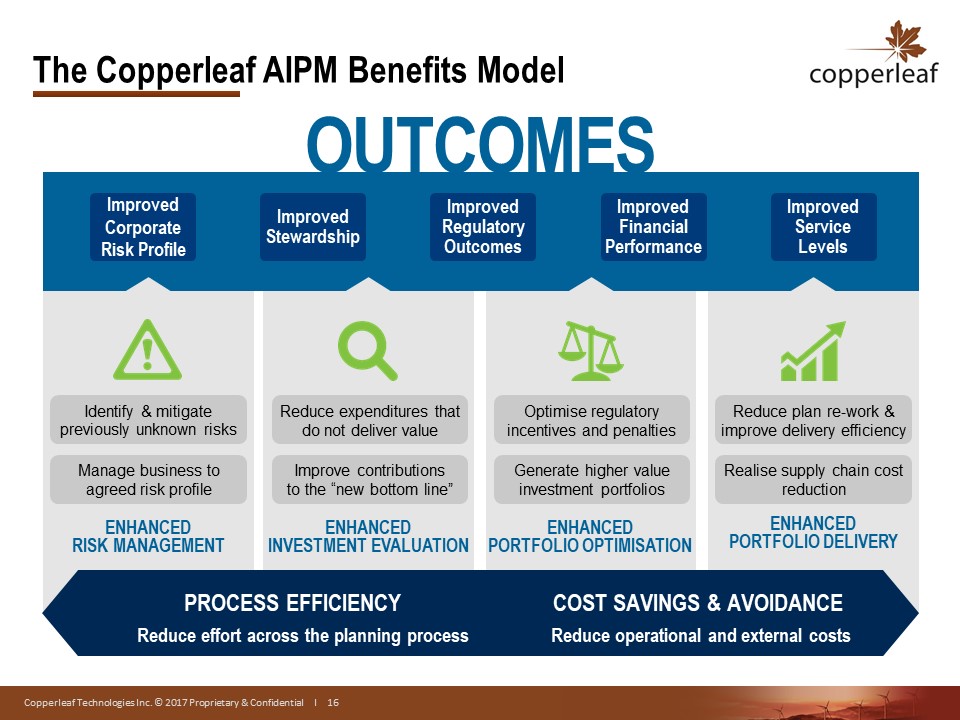

Copperleaf has aggregated these examples and created a ‘benefits framework’ to help clients like Northern Gas Networks describe the benefits of AIPM to internal and external stakeholders, and quantify the expected Return on Investment.

During the webinar, Sadnicki presents this research and highlights how utilities have applied this framework to develop their own business cases for investing in AIPM practices.

The benefits model comprises 15 different benefit measures split into seven categories and four pillars related to improved decision making.

Meanwhile, Sadnicki cites anecdotal support of implementing new AIPM capabilities with one client telling Copperleaf: “We just cut $7 million and it took us about 30 seconds. And the guys are telling us that it lines up with their engineering judgement”.

Dodd concludes with one note of caution, however. The system is only as good as the data used to populate it.

“In parallel with the work we’re doing with Copperleaf on AIPM, we are also running a significant data refresh and improvement plan to make sure outputs are robust and based on high-quality data.”

To learn more about the benefits that can be achieved from improving Asset Investment Planning & Management processes, please download our eBook.