Webinar Recap: Operationalizing and Reporting on ESG

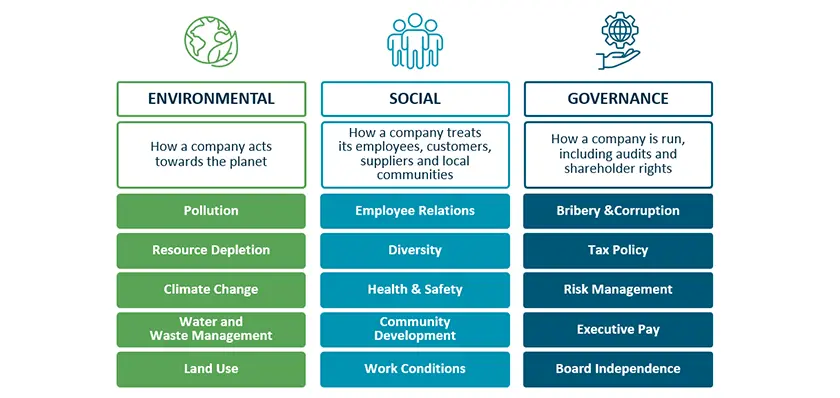

Environmental, Social, and Governance (ESG) factors are becoming increasingly important in decision making. We are witnessing a shift towards stakeholder capitalism, a system in which companies strive to create long-term value not only for shareholders, but to serve the interests of employees, customers, suppliers, communities, and society at large. Meeting the needs of these diverse stakeholders groups requires greater accountability and transparency, which is creating an increasingly complex and volatile ESG reporting landscape.

In a recent webinar, Kim Knickle, ESG & Sustainability Research Director at Verdantix, an independent research and advisory firm, and Boudewijn Neijens, CMO at Copperleaf®, discuss how and why the ESG disclosures landscape is evolving, what organizations can do to turn aspirational goals into operational plans, and how to report on ESG-driven business objectives.

In the following clip, Boudewijn discusses the shift towards stakeholder capitalism and the need for organizations to define “value” in broader terms and demonstrate progress toward ESG goals.

Addressing the Inevitable: ESG Reporting

Historically, ESG reporting has been voluntary and explored mostly on an annual basis. However, as Kim discusses in the clip below, reporting will become mandatory and regulated as the ESG landscape evolves: “It used to be that we would expect we’d pull the sustainability data together once a year,” explains Kim. “That just isn’t realistic anymore.”

Today, ESG reporting requirements can vary depending on an organization’s region and industry. In the EU for instance, there are new requirements for corporate reporting. This creates more complexity, but it also results in a common language that will make it easier for stakeholders to understand how much progress is being made towards ESG goals.

In the US, the SEC has not made official changes, but is asking for more clarification on financial filings and may begin comparing them to ESG reports. As Kim explained, “we have this move to increasingly link financial information with ESG and sustainability performance.”

One thing that is consistent across regions and industries is that stakeholders are no longer willing to accept aspirational plans. They are demanding evidence that organizations are serious about their ESG goals. And the only real way to hold businesses accountable is to expect full transparency through more frequent and robust reporting.

Asset Management and ESG

For asset-intensive organizations, some elements required in ESG reporting have already triggered major transformation initiatives at many organizations. A critical area is the need to manage risks due to climate change and related extreme weather events. Asset resilience and hardening are key topics for asset managers tasked with ensuring performance under rapidly changing operating conditions.

These transformation initiatives often highlight one of the key challenges faced by asset managers: how to keep existing assets performing reliably and economically while reallocating resources to new initiatives, which often require significant investment.

How can asset managers respond and help their organizations leverage ESG as an opportunity to genuinely make the world a better place, while remaining profitable? In the following clip, Boudewijn explains, “the number one element is the need for a value framework . . . a rational and systematic way of capturing all of those value elements.”

Unlike purely financial objectives that are easy to quantify and measure, ESG-related goals are more challenging to express in tangible terms everyone can agree on. Copperleaf helps organizations expand their assessment of project value by quantifying ESG and financial measures on a common economic scale.

The Copperleaf Value Framework provides an enterprise-wide view of all the value measures that support your strategic goals—as well as the models used to calculate how individual investments or projects will contribute to those goals. This ensures all relevant ESG criteria are accounted for, used in business cases, and valued consistently. This drives consensus and links day-to-day decisions with business strategy, creating a culture of transparency, accountability, and trust.

Watch the full webinar to learn how your organization can turn aspirational ESG goals into operational plans, and report on them with confidence.