Does your organization’s spending effectively support your strategic objectives? Do you have a direct line of sight into investments across your enterprise to optimize plans in the short, medium, and long term?

Create the best possible investment plans

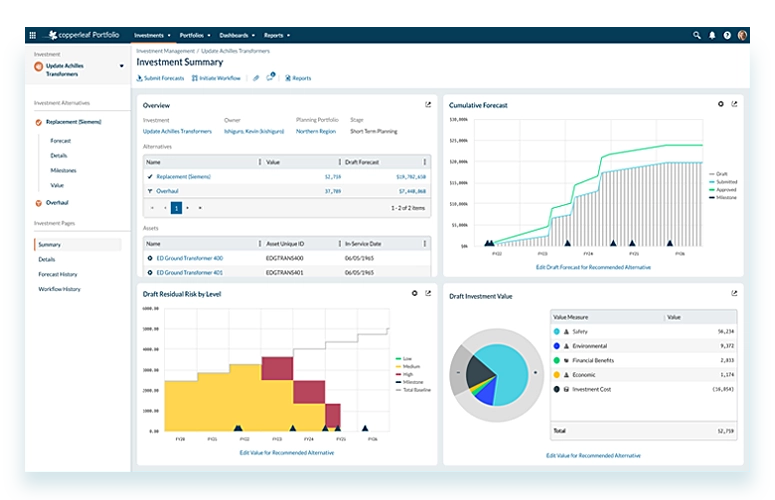

The Copperleaf® Decision Analytics Solution streamlines the process of developing, approving, and managing investments through their full lifecycle. It provides a centralized, enterprise-wide platform to capture all candidate investments, allowing them to be scoped, costed, valued, and organized into portfolios. Our software helps finance professionals:

- Assess the benefits of all investments consistently to make trade-off decisions with confidence

- Optimize investment portfolios to maximize value and drive strategic outcomes, while respecting multiple operating constraints

- Identify which investments to defer when there are funding or cash flow constraints

- Create what-if scenarios to compare and contrast the value, timing, risks, and costs of different investment strategies—to build a robust, defensible plan

Planning for the long term

In this video, investment planning professionals from Network Rail, National Grid, and Northumbrian Water discuss how the Copperleaf Decision Analytics Solution is helping them make the right investments at the right time and demonstrate value for money from investments more accurately.

Copperleaf Portfolio: ROI

Return on Investment (ROI) is a key consideration when investing in any enterprise software solution. Through case studies and independent research, we have collected a robust data set to quantify the benefits Copperleaf clients have realized. The benefits are focused on four areas:

- Higher-value plans

- Planning process efficiencies

- Improved plan execution

- Benefits to drive strategy

Building a defensible investment plan streamlines regulatory approval

Today’s investment planning landscape looks drastically different than just 15 years ago. Utilities must perform more detailed cost and benefit analyses to show regulators that the most optimal investment plan has been selected, considering all stakeholder needs and requirements.

Copperleaf and Black & Veatch helped a US electric utility develop and gain approval on a $2 billion grid modernization plan that will deliver $6.8 billion in benefits to customers and the economy over a 6-year planning horizon.

Risk, value, finance, and decision making

Many organizations use “cut line” techniques to determine which projects to fund: rank the projects by value, then add up the costs of the projects while going down the list and stop when all funds have been allocated. This very basic approach generally does not lead to the most efficient use of money or resources.

Better techniques are available to solve this challenge. These solutions take into consideration multiple strategic objectives and determine which projects will deliver the highest possible value to the organization while honoring all targets and constraints (financial, resources, risk tolerances, timing, dependencies, etc.).

The business case for enterprise portfolio management

In this webinar, experts from Accenture and Copperleaf discuss the impact of new technologies on the energy sector and how organizations have many more projects and assets to contend with—requiring a transformation of PPM processes to help them select the optimal portfolio of projects to execute. This article highlights five keys to success for asset-intensive organizations.

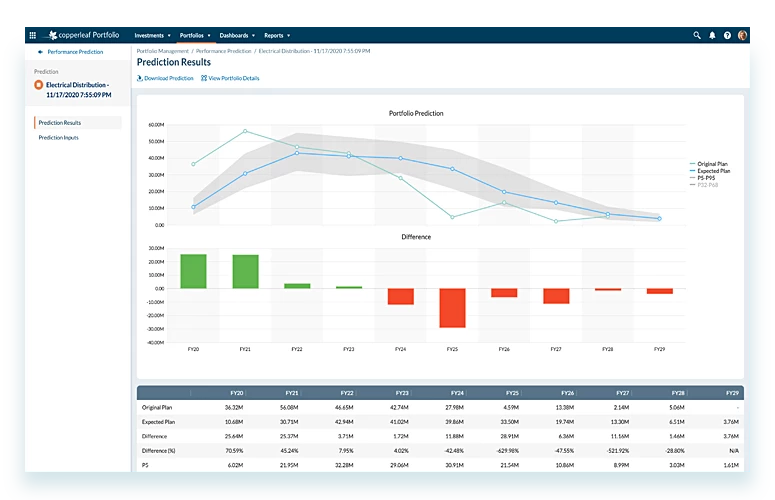

Predict plan performance using machine learning

Copperleaf’s Performance Prediction capability helps organizations gain accurate insights into the expected costs, benefits, and risks mitigated by their capital plans. It uses machine learning (ML) and statistical analysis techniques to predict the performance of investment portfolios based on historical data.

With Performance Prediction, you can account for cost and schedule uncertainties and use this information to understand the likelihood of overspending or underspending—and make contingency plans accordingly.

Adopted by Industry Leaders

Integrated AIPM process at National Grid Gas Transmission

National Grid Gas Transmission (NGGT) owns and operates the high-pressure gas transmission network in Great Britain. The Copperleaf solution will help NGGT deliver its business plan as cost-effectively as possible, contributing to a 4% efficiency on capital expenditure, saving £11 million per year.

Best practices for capital planning excellence

A multinational midstream company implemented the Copperleaf Decision Analytics Solution as part of an enterprise-wide asset management transformation. Capital planning excellence has enabled the organization to streamline operations and transform its decision-making processes to realize 15% more value from its investment portfolios and secure a 30% increase in maintenance capital spend.