Webinar Recap: Asset Management and Decision Making in Uncertain Times

In a recent webinar hosted by Smart Energy International, Copperleaf® Regional Sales Manager, Conor Toal, and Customer and Partner Success Manager, Richard Hawkins, were joined by Mark Kaney, Director of Asset Management at Binnies, to discuss decision making and planning in today’s uncertain times. As budgets shrink and work is deferred, understanding asset risk and the full lifecycle consequences of decisions is becoming increasingly important.

The Evolution of Decision Analytics for Asset-Intensive Businesses

Conor explained how asset management is a moving target: “Ten years ago, our clients were mainly focused on the long term. Asset managers were primarily concerned about having the capital and resources to replace or refurbish assets with a lifespan of 50 to 100 years.” This meant building a long-term capital plan from the bottom-up—which is also what regulators were looking for at the time.

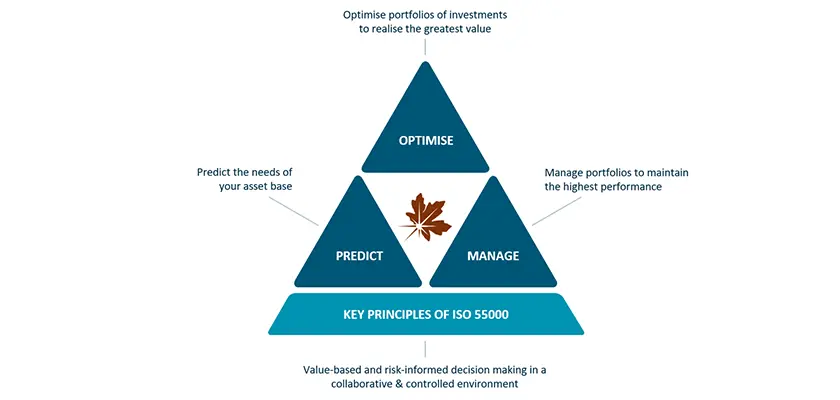

In recent years, it has become crucial for utilities to look more closely at short-term and medium-term investment plans as well. The need to predict long-term asset needs has evolved into a focus on making value-based project and portfolio decisions in a collaborative and controlled environment.

Quantifying Uncertainty

Utilities and asset-intensive organisations are becoming far more data driven in their decision-making processes. According to Mark: “In simpler times, there was a perception that decisions could be made based on experience or expertise. Things are far more complex now. Organisations are looking to quantify uncertainty and need the ability to run ‘what-if’ scenarios to make decisions confidently.”

Conor explained how Copperleaf clients have started using machine learning to understand the impact of uncertainty on expected portfolio performance.

Read our blog post to learn how machine learning can help predict the performance of your investment plans.

Adopting Digital Tools to Support Asset Management

As utilities digitise more aspects of their businesses, they are becoming more data rich. Richard reminded attendees that no organisation has perfect data: “The key is to start with the data you have. This will help you prioritise what you should collect to make the best decisions. Focus on establishing processes and centralising the information—and let that drive improvements in data.”

The data you’re already collecting can be used to feed digital tools and enhance decision making. Basic predictive models that take into account the likelihood and consequence of asset failures can be incorporated into the planning process to model various scenarios. As your data matures, the models can evolve as well. This type of analysis can help answer questions from a range of stakeholders before the plan is even built.

One such stakeholder is, of course, the regulator. With the global shift to performance-based regulation, regulators want to see higher levels of rigour in decision making. Utilities need to track the outcomes of their activities, and prove they are delivering the benefits promised.

View the full webinar here.