Webinar Recap: The Utility Perspective – Navigating the Evolving Regulatory Landscape

I recently had the pleasure of participating in a webinar focused on how benefit-cost analysis (BCA), what-if scenarios, and investment portfolio optimization are helping utilities provide greater transparency to regulators, customers, and other stakeholders. Fellow speakers included:

- Andrew Wells, Associate General Counsel, Duke Energy

- Jason Jones, Director of Generation, Public Service Company of New Mexico

- Jim Shields, Principal Consultant, Black & Veatch

Asset investment planning is already complex, and evolving regulatory requirements are making it clear that traditional ways of reporting won’t measure up when it comes to meeting new objectives.

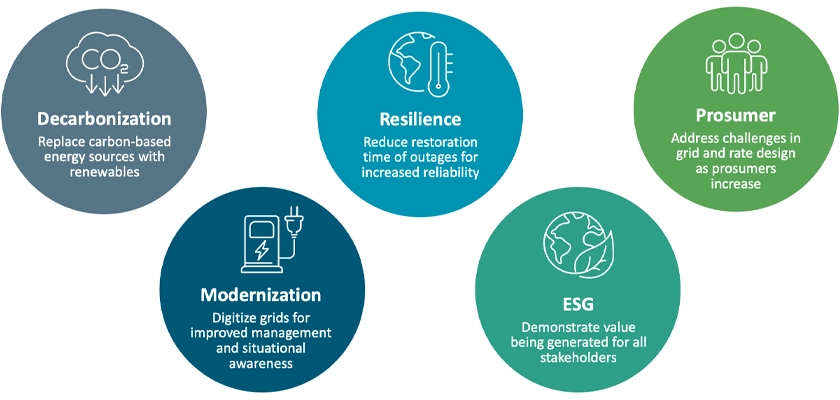

The Energy Transition Act in New Mexico, for example, provides deadlines for decarbonization by 2040, which utilities must meet while keeping their systems resilient. Ten years ago, plans focused on maintaining and replacing aging infrastructure. Now, there’s also an emphasis on ensuring investments contribute to decarbonization, modernization, resilience, prosumer, and Environmental, Social, and Governance (ESG) objectives.

Trending regulatory and utility objectives

New Objectives Require New Solutions

More objectives mean more ways to meet them, which can increase the number of potential projects. But performing BCAs becomes unmanageable once the number of projects balloons into the thousands, each with their own costs, benefits, and constraints.

As Jim Shields explained, utilities need new tools and processes to handle this volume and complexity as they evaluate and compare project benefits, so they can ultimately optimize and justify their investment plans.

We need to start thinking in terms of tools and processes that allow us to capture all the benefits and programs where investments could be made, and then be able to demonstrate to all stakeholders how we derive those benefits…demonstrate that the investments are worth investing in.

Jim Shields

Principal Consultant

Black & Veatch

Using a consistent process to perform BCAs and align investments with regulatory and strategic objectives, is key. Ultimately, regulators are seeking to ensure the investments utilities are making are prudent, and that the costs are justified by the incremental benefits. Leading utilities are better prepared to answer this by implementing these best practices:

- Quantify value by monetizing the benefits of all programs and projects

- Optimize investment plans to meet all constraints and targets, and deliver maximum value to customers

- Demonstrate how plans support ESG-related objectives

Build Line of Sight from Investments to Regulatory and Strategic Objectives

In large organizations where projects can come from anywhere in the business, it can be challenging for everyone to agree on what delivers the most value when not everyone has the same perspective and access to the same information.

Jason Jones talked about the challenges in achieving this alignment: “We’re a hundred-year-old utility, we’re vertically integrated. We have separate generation, transmission, distribution departments. Even breaking down the internal silos and getting different departments together to talk about a single project to agree on…it’s not an easy undertaking. Our ultimate goal is to bring the most value to the customer.”

Creating a Value Framework is a collaborative process that helps break down these silos—by establishing a common definition of value that can be used to assess all projects. It provides an enterprise-wide view of all the value measures that support the strategic goals—as well as the models used to calculate how individual investments or projects will contribute to those goals.

Here, I talk about how the process of building a Value Framework creates a clear line of sight from planned investments to regulatory and corporate targets, allowing utilities to provide transparency into the decision-making methodology—and demonstrate the benefits of their plans to regulators, stakeholders, and customers:

Optimize the Plan to Deliver Maximum Value to Customers

Once organizations have a consistent way to evaluate and monetize the benefits of all programs and projects, the next step is selecting which ones to pursue and when. Every organization faces real-world constraints, such as available budget or resources, and the trick lies in selecting the right investments that deliver on targets while respecting those constraints.

Copperleaf’s solutions leverage advanced analytics to evaluate hundreds of thousands of possible investments and identify the optimal plan within minutes. Multiple what-if scenarios can be created to compare the impact of different funding, timing, and resource constraints on risk and value—to determine the best overall investment plan that maximizes benefits to customers.

Andrew Wells explained how Copperleaf and Black & Veatch helped Duke Energy distill a large pool of projects into a $2B investment portfolio that was ultimately approved by the regulator. The plan involved many transmission and distribution programs with hundreds of projects within each program: “When we started developing the plan, we had over $4B worth of candidate projects that were being considered. We needed a way to grade the projects, score them, and decipher it down into a portfolio that we ultimately presented to the commission that had a quantified BCA that was strong and made sense.”

Demonstrate How Plans Support ESG-related Objectives

Increasingly, regulators are requiring utilities to demonstrate how investment plans will impact communities.

In pretty much all the recent filings, the questions we’re asked is “Which communities are benefitting or impacted the most?”

Jason Jones

Director of Generation

Public Service Company of New Mexico

The development of a Value Framework described earlier, helps organizations quantify all the different financial and non-financial benefits that can come from projects, including factors related to ESG, so that investments can be compared on an even playing field.

We can then use readily available data in screening and mapping tools such as EJScreen, to understand the demographics of the underlying communities and see the level of risk that’s impacting those communities today. From there, organizations can use Copperleaf to model the impact of investment plans against that baseline, and create different what-if scenarios to compare the impact of different spend levels and constraints—and develop a plan that ensures a fair outcome for all communities.

Use Data and Value Provide a Complete Picture

A data-driven planning process provides clarity and transparency by demonstrating the alignment between investments, objectives, and outcomes. In this video clip, Andrew Wells explained how this approach helped Duke Energy develop a robust plan and convince regulators and intervenors of the rationale and value in pursuing the chosen projects.

The nice thing that I appreciated coming from the legal perspective was we were able to show the process, the value measures, those metrics, that granular data…we were able to tell the story.

Andrew Wells

Associate General Counsel

Duke Energy

Black & Veatch’s industry and regulatory experience and Copperleaf’s decision analytics solutions are helping utilities ensure decisions around where and when to invest are more equitable, transparent, and defensible.

For more details on how this approach can help your organization develop, communicate, and defend your asset investment plans, watch our on-demand webinar on The Utility Perspective: Navigating the Evolving Regulatory Landscape.